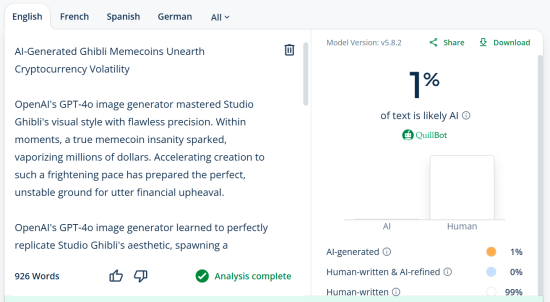

OpenAI’s GPT-4o image generator mastered Studio Ghibli’s visual style with flawless precision. Within moments, a true memecoin insanity sparked, vaporizing millions of dollars. Accelerating creation to such a frightening pace has prepared the perfect, unstable ground for utter financial upheaval.

OpenAI’s GPT-4o image generator learned to perfectly replicate Studio Ghibli’s aesthetic, spawning a memecoin frenzy that vaporized millions in minutes. Of course, speculative traders rushed to tokenize AI-generated art. That created volatile assets that crashed with horror-film brutality. A massive daily positive netflow of $162,084 Ethereum to USD hit Binance on December 5, 2025. Infrastructure supporting these digital hauntings operates at a scope most casual observers can’t fathom.

Anyone with a text prompt could suddenly generate masterpieces

Zero years studying animation required. No understanding of composition or color theory needed. Only instructions whispered to an algorithm produced artwork. That Ghibli-inspired output was almost indistinguishable from hand-drawn pieces created by actual human artists over months of painstaking labor.

Analysis of the top 50 meme projects reveals that 32 of them run on Ethereum, making it the primary feeding ground for speculative tokens. Blockchain networks host millions in market capitalization for assets existing purely as vehicles for rapid trading. Memecoins carry volatility that makes established cryptocurrencies look pretty tame. These assets show “extra-high volatility” as a consequence of high virality and short-term traders hunting for quick turnaround.

Supernatural returns infected socials quicker than rational thought

Binance research shows the memecoin sector recorded the highest average returns of 736% year-to-date in one period. Driven by low entry barriers and speculative fever, this happens all the time. Early participants captured gains so explosive they defied probability. But they posted screenshots across social channels like found footage from something that shouldn’t exist. Others watched those returns, felt FOMO tighten their chest, then rushed into subsequent launches unprepared.

Automated memecoin sniping bots initiate transactions too fast for any human being. Bots leave manual traders in the dust (you barely even stand a chance). Algorithms find their mark with chilling accuracy and buy orders execute milliseconds after liquidity pools open. Human fingers still hover over keyboards contemplating risk while bots have already extracted value and moved on to the next kill. Can anyone actually profit when you’re always wondering if you’re the mark?

Miyazaki’s disgust reads like an Elder’s warning of the future

Hayao Miyazaki voiced his “disgust” and concern over AI-generated art. He stated that he feels humanity is “losing faith in ourselves” by relying on generative tech. Beyond artistic preferences, creating commercial assets from AI-replicated styles without permission invites legal problems. Unfortunately, most memecoin creators blissfully ignore the risks until cease-and-desist letters arrive.

Copyright law struggles to contain entities born from algorithmic mimicry rather than human authorship. Regulatory clarity accelerated institutional adoption. According to global crypto policy reports, financial institutions in about 80% of reviewed jurisdictions announced new digital asset initiatives for 2025/26. Securing global licenses, Binance and other major exchanges provide some stability to established players. Still, memecoin regulation remains a chaotic, ungoverned space.

Even as this chaotic cycle accelerates, Richard Teng, CEO of Binance, reminds everyone where the true focus lies: “The fundamental infrastructure of our industry is improving, but the speed of these cycles means security, compliance, and user protection cannot be afterthoughts. They have to be the foundation.”

Crashes arrived with the sudden shock of horror movies

Binance data confirms drops of 80% to 90% in minutes are standard for these assets. Such volatility creates digital graveyards littered with shattered portfolios. Ghiblification (GHIBLI) hit a $28.3 million dollar market cap before plummeting to $18 million. GhibliCZ spiked to $14.6 million before collapsing to $4.3 million, according to Bitcoin market data. Carnage unfolded with brutal inevitability. It was like watching characters walk into basements in slasher films, knowing exactly what’s coming for them.

Liquidity evaporated the instant sentiment flipped. Established assets maintain structural advantages during panic. Continuous cash inflow and large user bases of BNB benefit from stronger fundamental support and greater potential for value recovery during broad market downturns. Memecoin holders possessed no such protection. Price discovery happened through pure speculation. Exit liquidity depended entirely on finding new victims willing to absorb catastrophic losses.

AI and horror protagonists are prone to hallucination

Projects appear without proper vetting, sustainable economics, or accountability structures. Developers summon tokens in mere hours, then simply vanish. Investors are left holding digital remnants that are worth nothing. Automation accelerates both creation and destruction at speeds that completely outpace human comprehension. Facing unpredictable forces without preparation typically ends in disaster.

Facing unpredictable forces without preparation typically ends in disaster. Looking at releases like 28 Years Later exploring populations overwhelmed by chaos they never anticipated, you start recognizing familiar patterns in how quickly control evaporates. What took weeks in earlier crypto eras now completes in a single afternoon. Still, very basic questions about defining value remain unanswered as new tokens spawn daily.

Invisible bots hunt with algorithmic precision. And panic spreads through social channels faster than rational thought can intervene. Films like The Conjuring: Last Rites deal with a relentless evil. That evil compounds with each passing moment until escape becomes impossible. Sound familiar? AI replicates artistic styles with perfection never before possible.

Psychological triggers override rational decision-making on a massive scale. Regulatory systems lag pretty far behind technological capabilities. What’s emerging feels less like financial innovation and more like watching something terrible birth itself repeatedly. Ghibli memecoins exposed a pretty dark truth about what happens when creation speed outpaces ethics and greed finds new technological vessels to possess.

Horror News | HNN Official Site | Horror Movies,Trailers, Reviews

Horror News | HNN Official Site | Horror Movies,Trailers, Reviews